For More Than Half Of Australian Properties It’s Cheaper To Buy Than It Is To Rent

In the first quarter of 2021, Australia experienced a record-breaking rise in house prices, the sharpest increase in nearly 18 years. However, a new realestate.com.au analysis shows it’s cheaper to buy than rent more than half of properties in Australia, and it’s all due to record low mortgage interest rates.

The inaugural REA Insights Buy or Rent Report clearly showed that, despite climbing house prices, conditions are still favourable for buyers. Based on a 10-year analysis of costs associated with renting and buying, and house property prices today, in 57% of properties across Australia it’s still cheaper to buy than rent. Author of the REA report, Paul Ryan, said that research clearly shows that exceptionally low borrowing costs are behind most of the increase in demand as seen in late 2020 and early 2121.

With the Reserve Bank of Australia committing to keeping interest rates low until at least 2024, buyers today can comfortably borrow larger amounts of money. Low mortgage interest rates means that many Australians can save money by buying property, instead of renting. Currently, interest rates can be fixed below 2%, and buyers now have certainty that mortgage costs are not going to rapidly increase.

The analysis results did differ by property type; over the next 10 years just over half of houses will be cheaper to buy than rent; however, that figure leaps to 75% for units.

For many people in Sydney and Melbourne, renting still remains the cheapest option. The findings of the REA Insights Buy or Rent Report suggest that rental growth will remain soft, especially outside Sydney and Melbourne.

A separate study carried out by Domain revealed that, in a third of all Australian suburbs with reliable statistics, it’s cheaper to buy a property than pay rent. What was most surprising however, is that in some cases mortgage repayments add up to less than half the weekly rent. The study also revealed that there are almost 37% of suburbs where it’s cheaper to buy a property than rent one, which is great news for first-home buyers trying to get into the property market. It’s also good news for investors who are wanting to add to their property portfolio – they can positively gear their properties and receive more rent that it costs them to own the property.

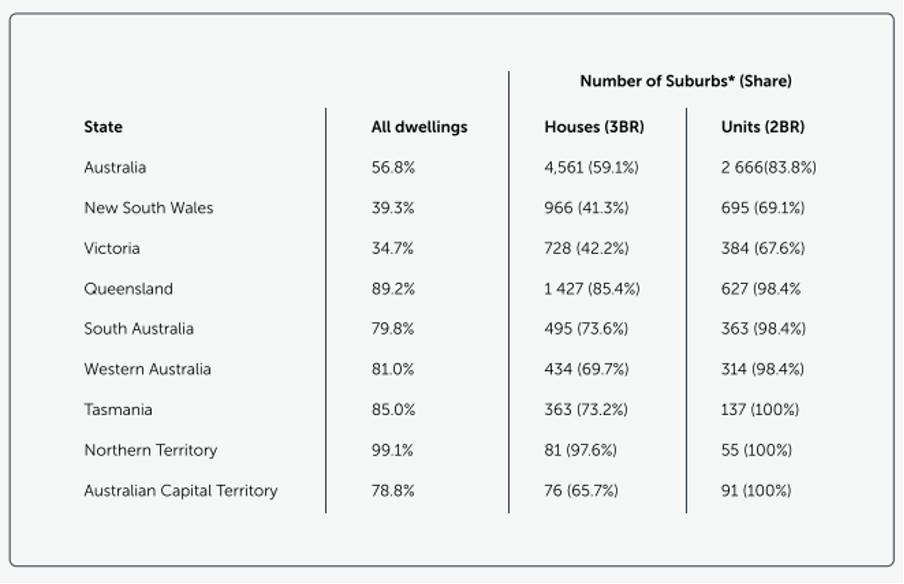

The number of suburbs where buying is cheaper than renting.

Source: REA Insights buy or rent report

With affordability driving demand and continuing strong regional price growth, buying conditions are especially positive outside of Victoria and New South Wales, with almost all units and 80% of houses estimated to be cheaper to buy than rent over the same period.

For example –

- In the Northern Territory it’s cheaper to buy than rent 100% of units and almost 98% of houses.

- In Queensland it’s cheaper to buy than rent 89.2% of homes.

- In Tasmania that figure is 85%

- In Western Australia it’s cheaper to buy than rent 81% of homes.

- In South Australia that figure in 79.8%.

- In the ACT it’s cheaper to buy than rent 78.8% of homes – this is despite soaring prices.

But on the other end of the scale, it’s cheaper to buy than rent in only 42.2% of houses in Victoria and 41.3% of houses in New South Wales. The figures are slightly higher for units, with 67.6% for Victoria and 69.1% for New South Wales.

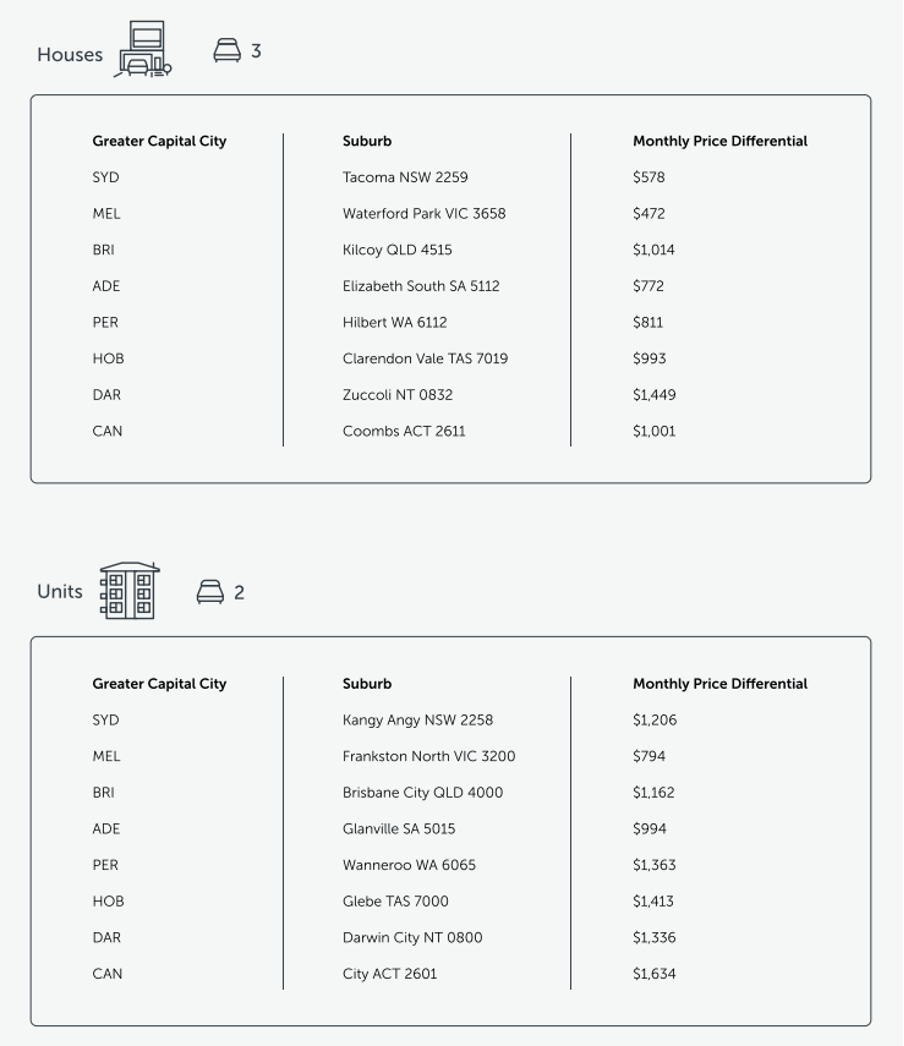

Suburbs where it’s cheapest to buy in each major city

Source: REA Insights buy or rent report

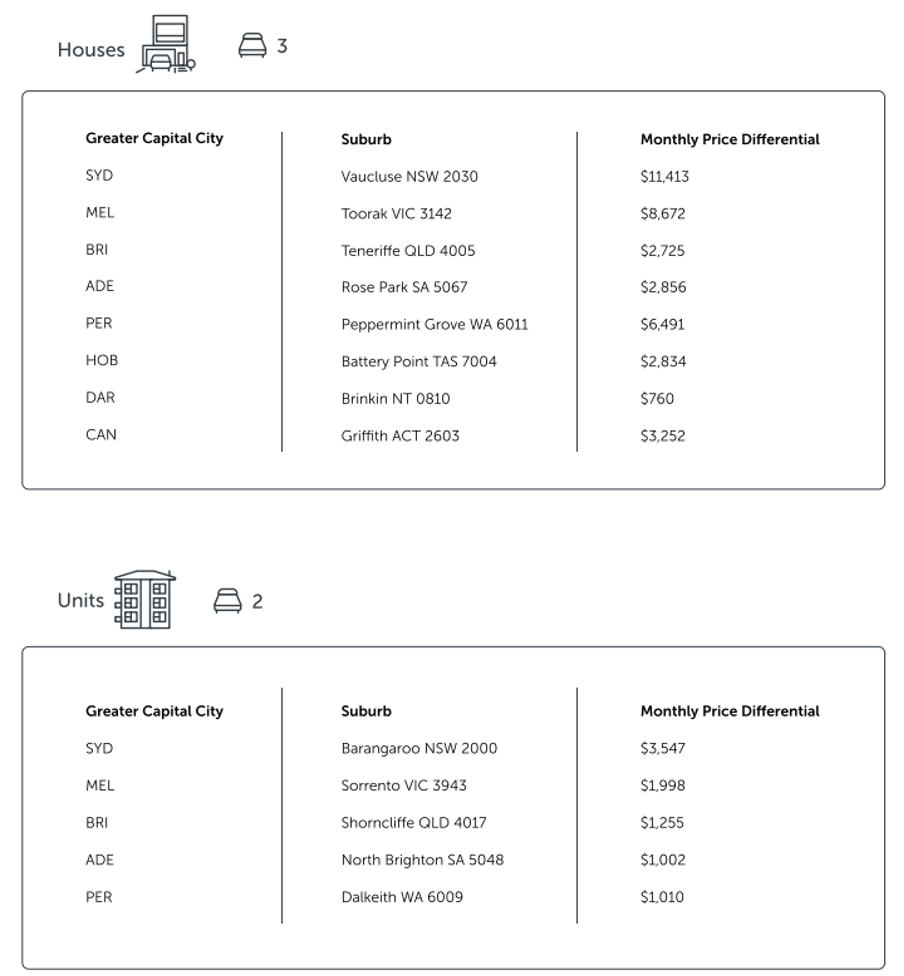

Suburbs where it’s cheapest to rent in each major city

Source: REA Insights buy or rent report

The Data Is Mainly Being Driven by Low Mortgage Interest Rates

With the Reserve Bank of Australia committing to low-interest rates until the year 2024 at least, buyers borrowing larger amounts can feel secure in the knowledge that there will be no increase in mortgage costs any time soon.

The REA report states that moderate property price growth will more than likely offset any additional costs of owning, given low-interest expenses. ‘Costs of owning’ include stamp duty, the cost of engaging an agent, ongoing costs like maintenance, and strata or council rates.

However, for many Australians, including those who live in Melbourne or Sydney, renting is still the cheapest option. The combination of low average rents and high property prices mean it’s likely to be less expensive to rent than buy in just under half of units and more than 70% of houses over the next 10 years.

The report explains that rents don’t usually adjust as quickly as prices, but the immediate cessation of international travel caused by the COVID-19 pandemic resulted in significant drops in rental prices in inner-city Melbourne and Sydney. Because of this, renting in these same inner-city areas is now considered cheap when compared to their high asking prices. It’s believed this trend will ensure the current property boom continues, until such time as prices rise so much that affordability is stifled.

What About First-Home Buyers?

The analysis carried out by REA assumes that prospective home buyers already have their 20% deposit; however, with prices continuing to rise, the greatest challenge still faced by many buyers is the ability to save the required deposit. First-home buyers are being placed in a difficult situation because prices are increasing higher than they’re able to save for the deposit, which ultimately means they are missing out.

The loan repayments are affordable to most first-home buyers but saving for a deposit while also paying rent is a struggle. Unfortunately, it’s this deposit gap that’s responsible for keeping would-be buyers out of the market moving forward. As prices continue to grow, people finding themselves in this position could find that buying a home moves even further out of reach.

Established Home Buyers

It’s a completely different story for established home buyers. Property owners who wish to upgrade should not experience any difficulties, especially if their property has increased in value.

In Conclusion

On the basis of the REA report, Paul Ryan believes that investor activity in the housing market will continue increasing throughout 2021.